Evaluate the creditworthiness of farm borrowers.

Risk management with satellite technology and machine learning.

WizeRise

WizeRise

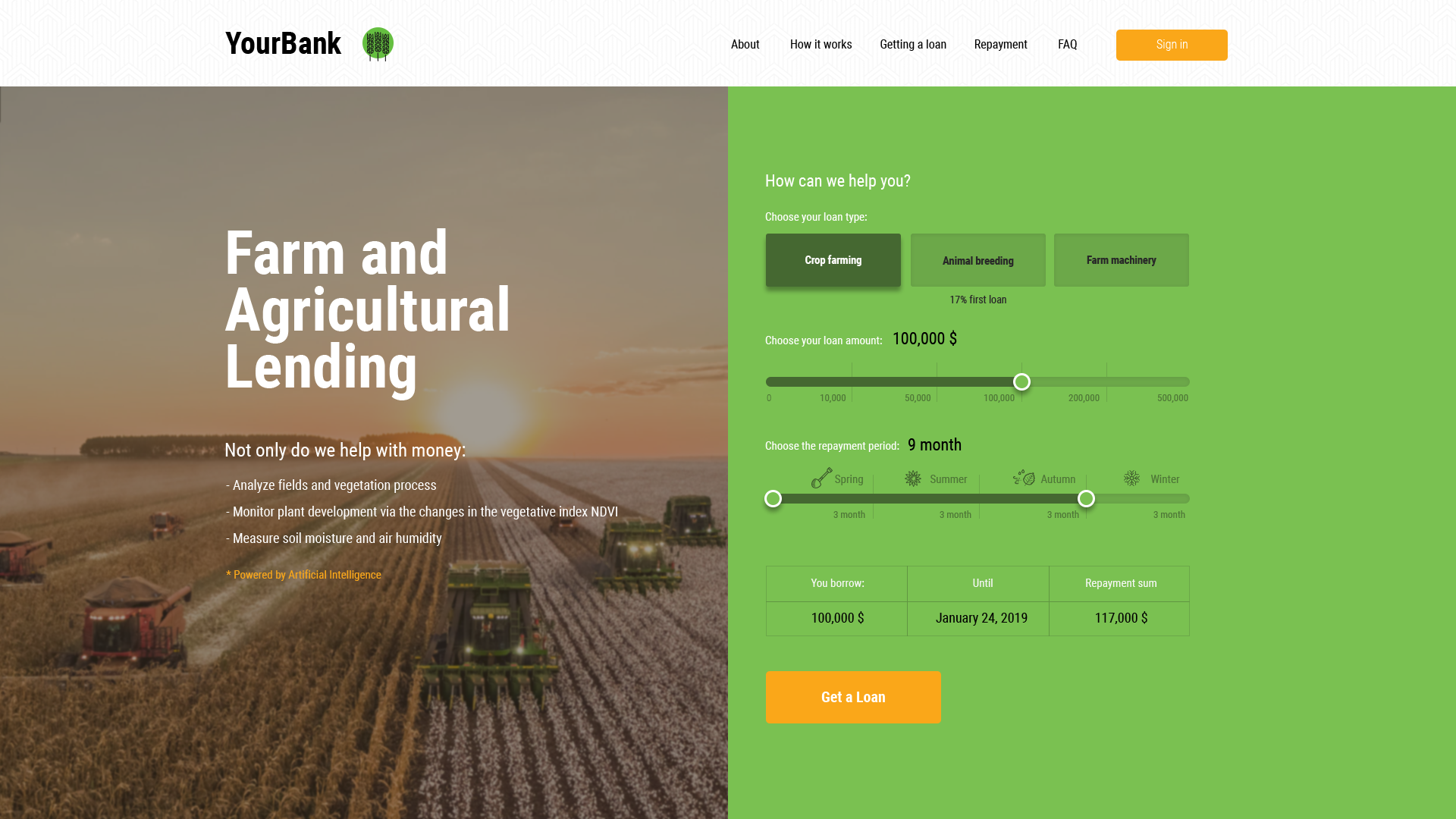

Evaluate the creditworthiness of farm borrowers.

Risk management with satellite technology and machine learning.

Modern agriculture is filled with big data that is rarely used. Combining predictive analytics and precision agriculture, the system converts field data into actionable insights.

WizeRise is all about finding valuable patterns during the loan application process and helping risk officers make better and more precise decisions without leaving the office.

WizeRise simplifies and boosts agricultural finance growth

Soon

Soon

Soon

Soon

Soon

Soon

Soon

Soon